va home equity loan texas

While there is no official VA home equity loan there is a VA-backed program that can help you access cash through the equity in your property. If you qualify you can also convert a.

The Ultimate Guide To A Va Loan Va Org

This loan allows you to take out a new VA mortgage for a larger amount than you currently owe providing the difference in cash.

. While not required for a VA loan a VA home inspection provides a complete top-to-bottom review of a property so you can make a fully informed decision before purchasing a home. Remember what we said about how each private lender sets its own rules. If you move sell the home and pay off the loan you may apply for reinstatement of your eligibility.

About Home Loans. This allows you to use your VA loan benefit on a subsequent home. In this article well discuss everything you need to know about the VA loan assumption.

Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan. But before you borrow learn more about home equity loans and compare home equity lenders to find the best. They come with a long list of benefits like no downpayment requirements and lower interest rates.

By constract a VA appraisal is required to qualify for a VA loan. As part of our mission to serve you we provide a home loan guaranty benefit and other housing-related programs to help you buy build repair retain or adapt a home for your own personal occupancy. Find out how to apply for a Certificate of Eligibility COE to show your lender that you qualify based on your service history and duty status.

VA home loans were introduced in 1944 as part of the GI Bill of Rights Act to ease the transition from military to civilian life. The VA home loan benefit helps veterans secure a home to live in full-time primary residence. Use a VA streamline refinance to lower the rate on a mobile home and lot you already own as long as theres a VA loan on the home currently.

For almost any need a home equity loan may be a good choice. A home equity loan allows you to tap the equity built up in your house to pay for renovations college expenses and other large purchases or to consolidate high-interest debt. VA helps Servicemembers Veterans and eligible surviving spouses become homeowners.

The VA cash-out refinance loan. A VA appraiser evaluates the property on behalf of the lender to make sure it meets two conditions. Lower the mortgage rate pay off a non-VA loan or obtain cash from your mobile homes equity through a cash-out refinance.

Keep in mind that for a VA-backed home loan youll also need to meet your lenders credit and income loan requirements to receive financing.

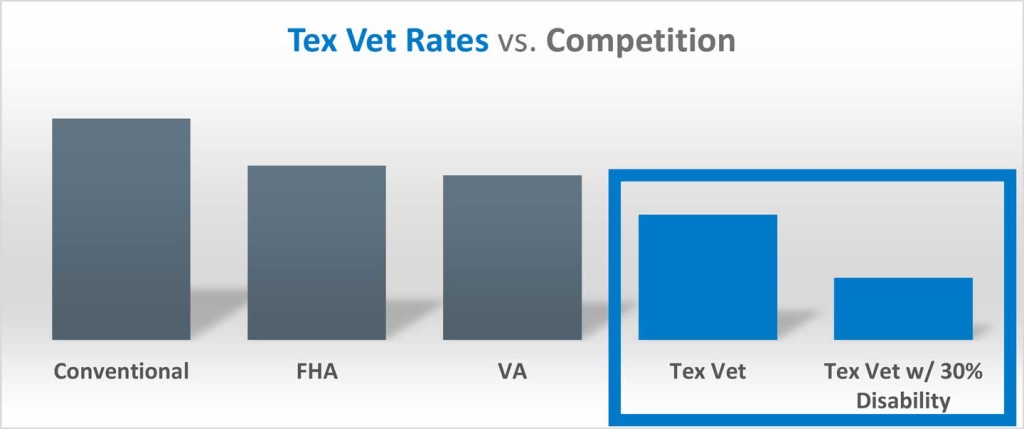

Texas Vet Va Loans Texas Veterans Home Loans

9 Best Va Loan Lenders Of March 2022 Money

The Texas Veterans Home Loan I Didn T Know About Until I Became A Realtor

Statistics Show Most Veterans Aren T Using Va Loan Benefits Nlc Loans

Are Va Loans Always The Best Choice For Veterans

What Can You Buy With A Va Loan Va Loan Loan Loan Forgiveness

Absolutely Everything To Know About The Va Home Loan In 2022

10 Things Most Veterans Don T Know About Va Home Loans Military Com

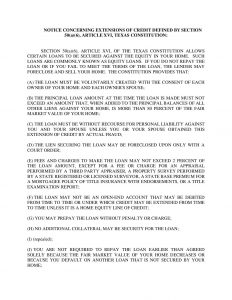

Texas Home Equity Cash Out Refinance A6 Mortgagemark Com

Va Home Loans For Veterans In Okc And Surrounding Areas

Texas Home Equity 12 Day Notice For Home Equity Loans Black Mann Graham L L P

Texas Mortgage Loan Va Loan Mortgage Loans Refinance Mortgage

Va Loan For A Second Home How It Works Lendingtree

Ten Things Most Veterans Don T Know About Va Home Loans Vantage Point

Va Home Equity Loan Options Military Benefits

Are There Va Home Equity Loans A Look At Options Lendingtree

Va Mobile Home Loans Manufactured Home Requirements 2022